Fraud against business is common.

Recently, Pasadena businesses have been visited by fake fire inspectors who represent themselves as official inspectors. ONLY UNIFORMED PASADENA FIREFIGHTERS can officially inspect your business. Please ask for identification from anyone who claims to be inspecting your business on behalf of the City of Pasadena or County of Los Angeles. If they are not a member of the Pasadena Fire Department (or Los Angeles County Fire, if you are in an unincorporated area), you do not have to allow an inspection.

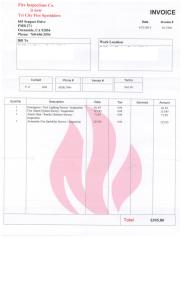

If you receive one of these bills (or someting like it) DO NOT PAY!

This is not a real bill, but a fradulant one seeking to get you to pay for services you did not receive.

Similarly, if you receive a call saying your water, electric, cable or phone service will be shut off if you do not immediately send money via a prepaid credit card, this is fradulent. Utility companies will communicate through the U.S. Mail, not over the telephone.

Finally, the Pasadena Star-News' business reporter Kevin Smith filed this story:

New identity theft fear: Getting your tax refund stolen

By Kevin Smith, San Gabriel Valley Tribune

Identity theft is nothing new.

Most consumers are aware of the massive security breaches that have occurred at companies like Target, Home Depot and Sony. And those who have been victims of personal ID theft know the aggravation that comes with sorting out the bogus charges on their credit cards, calling the bank and getting the charges removed.

But hackers have found yet another way to bilk people — by stealing their tax refunds.

Tax-refund fraud caused by identity theft is one of the biggest challenges facing the Internal Revenue Service. A Government Accountability Office report released last year noted that the IRS blocked $24.2 billion in fraudulent refunds requested in 2013, although the agency still paid out $5.8 billion.

But progress had been made.

In calendar year 2015 through November, the IRS rejected or suspended the processing of 4.8 million suspicious returns. As of last month, it stopped 1.4 million confirmed ID theft returns totaling $8 billion.

“It basically happens when you’re unsafe with your information,” said Michael Atias, tax director at Online Trading Academy, an Irvine-based business that provides financial education for traders and investors. “When you go online and use the same password for everything, like a birthdate ... or a birthdate with a different combination, it’s not hard for someone to figure it out. There are many ways criminals can get your information.”

Atias said taxpayers should be wary of possible identity theft if they receive an IRS notice or letter that says more than one tax return was filed using their Social Security number.

For the full story, click here: http://www.sgvtribune.com/general-news/20160224/a-new-identity-theft-fear-getting-your-tax-refund-stolen